LIVING IN PORTUGAL

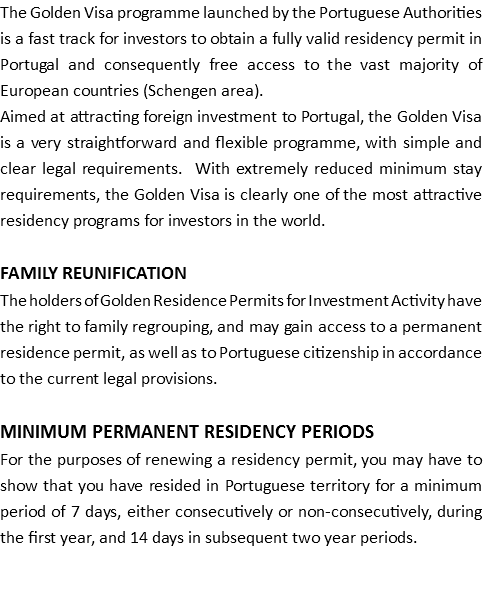

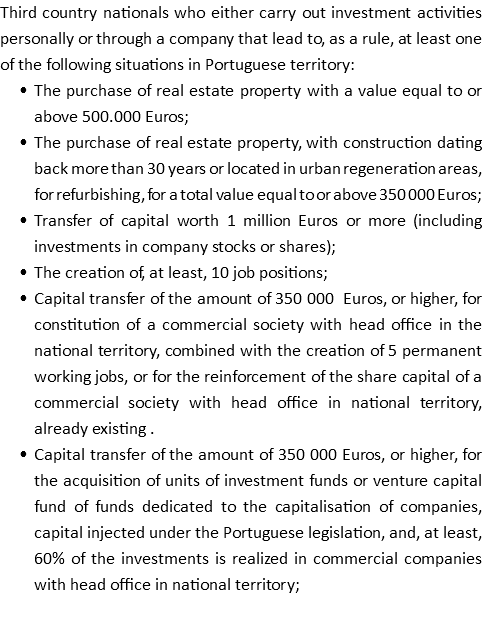

Have you considered owning a house in Portugal?

AICEP: www.portugalglobal.pt

One of the best places to live

diversity of landscapes and environments

PortugalGolfBooking: www.portugalgolfbooking.com

Portugal is Full of Opportunities

Taste Portugal...!

EVERYTHING

YOU CAN IMAGINE IS REAL...

Porto and Alto Douro Wine Region

Lisbon to Algarve

Madeira and Azores Islands